Green Transporter

Green Transporter Q-Express – 4-Wheel Electric Mobility Scooter - Top Speed 18mph - 1200W

Green Transporter Q-Express – 4-Wheel Electric Mobility Scooter - Top Speed 18mph - 1200W

- Regular price

- Price: $7,495.00

- Regular price

- List Price: $11,999.00

- Sale price

- Price: $7,495.00

- Unit price

- / per

In stock

Couldn't load pickup availability

Share

Disclaimer: Always consult with your local Motor Vehicle Department to ensure compliance with all applicable local, state, and federal laws regarding the use of e-bikes, mobility and recreational scooters. Please note that this information is for general purposes only and not legal advice. Read about the latest 2025 E-bike and Mobility Regulations here.

PRODUCT DESCRIPTION

PRODUCT DESCRIPTION

Green Transporter Q-Express

4-Wheel Transport Electric Mobility Scooter - Top Speed 18mph - 1200W

Discover the Green Transporter Q-Express – A New Standard in Enclosed Mobility

The Green Transporter Q-Express is a premium 4-wheel electric scooter that brings together comfort, protection, and performance—all in one sleek design. Whether you're heading to the market, commuting around town, or enjoying the outdoors, the Q-Express offers a quiet, enclosed ride that makes every trip feel effortless.

With a powerful 1200W motor and a top speed of up to 28 mph, the Q-Express lets you move smoothly and swiftly. Its long-lasting 60V 52Ah battery gives you a dependable range of 25–35 miles on a single charge, so you can go further without worry.

You’ll ride in comfort thanks to the fully enclosed cabin, electric windows, windshield defroster, and rear bench seat—all designed to protect you from the elements while enhancing your overall experience. For safety and control, the Q-Express includes front and rear disc brakes and a full digital dashboard with an LCD panel and backup camera.

Stay connected and entertained with the built-in sound system featuring two stereo speakers, USB, Bluetooth, and AUX inputs. The elegant design is available in Black with Red Trim, Red, or Blue—each one turning heads with its modern style.

Key Features:

- Fully enclosed design with electric windows and defroster

- 1200W motor, top speed up to 28 mph

- 25–35 mile range per charge

- LCD panel, digital dashboard, and backup camera

- High-quality stereo system with USB/Bluetooth/AUX

- Rear bench seat for added comfort

- Ships fully assembled, ready to ride

- 1-year limited warranty

Note: The Q-Express is intended for use on sidewalks and bike lanes only and is not street legal.

1200W

MOTOR POWER

18MPH

TOP SPEED

60V 52AH

WATERPROOF BATTERY

25-35 Miles

RIDING RANGE

550lbs

PAYLOAD CAPACITY

5’0” - 6’6”

RIDER HEIGHT

Featured Highlights

Dashboard

The digital dashboard displays your speed, battery level, and system status with a bright, easy-to-read LCD screen. Everything you need is right in front of you for a smooth, informed ride.

Interior

The enclosed cabin is quiet and comfortable, with a full windshield, solid roof, and ample legroom. You’ll stay protected from wind, rain, and sun while enjoying your ride.

Left Side

The left side features the secure locking door and mirror placement for visibility and ease of entry. It’s designed for safe, convenient access every time.

Bench Seat

A spacious rear bench seat provides comfortable seating for a second passenger or extra room for bags. Padded and supportive, it adds a practical layer of luxury.

Electric Windows

The power windows on both sides let you open or close the glass with a button—great for ventilation or quick communication without stepping out.

Right Side

On the right side, you’ll find more controls, with clean exterior lines and your choice of bold color. The design offers both function and flair.

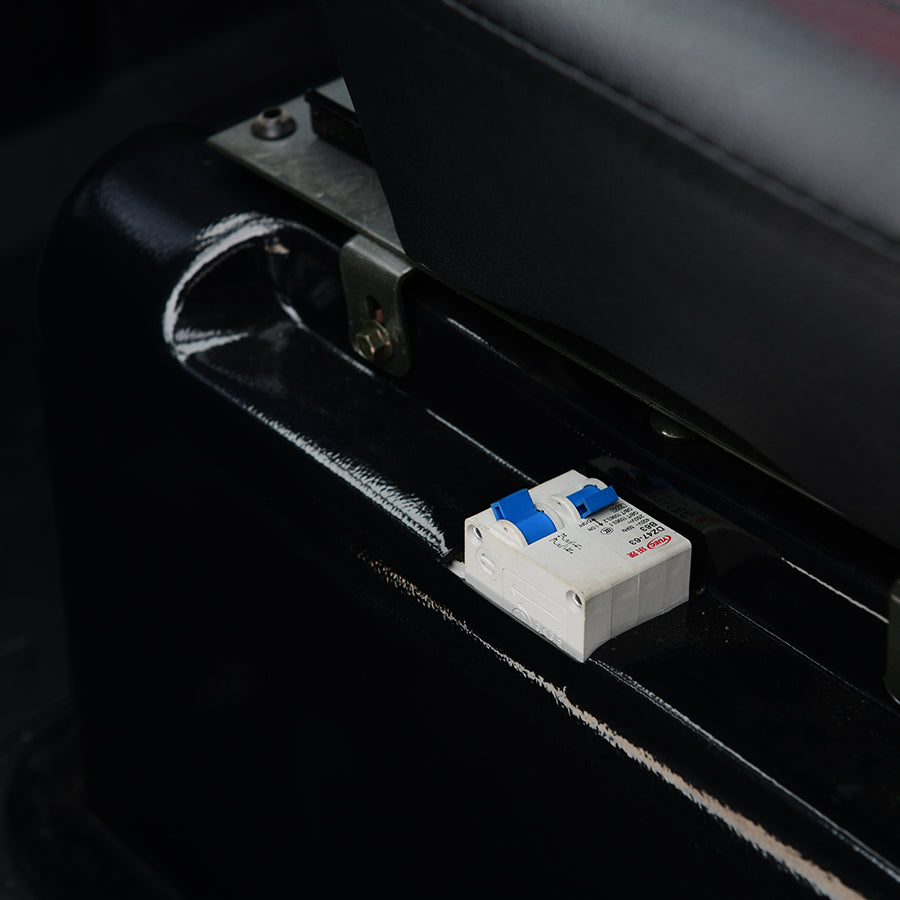

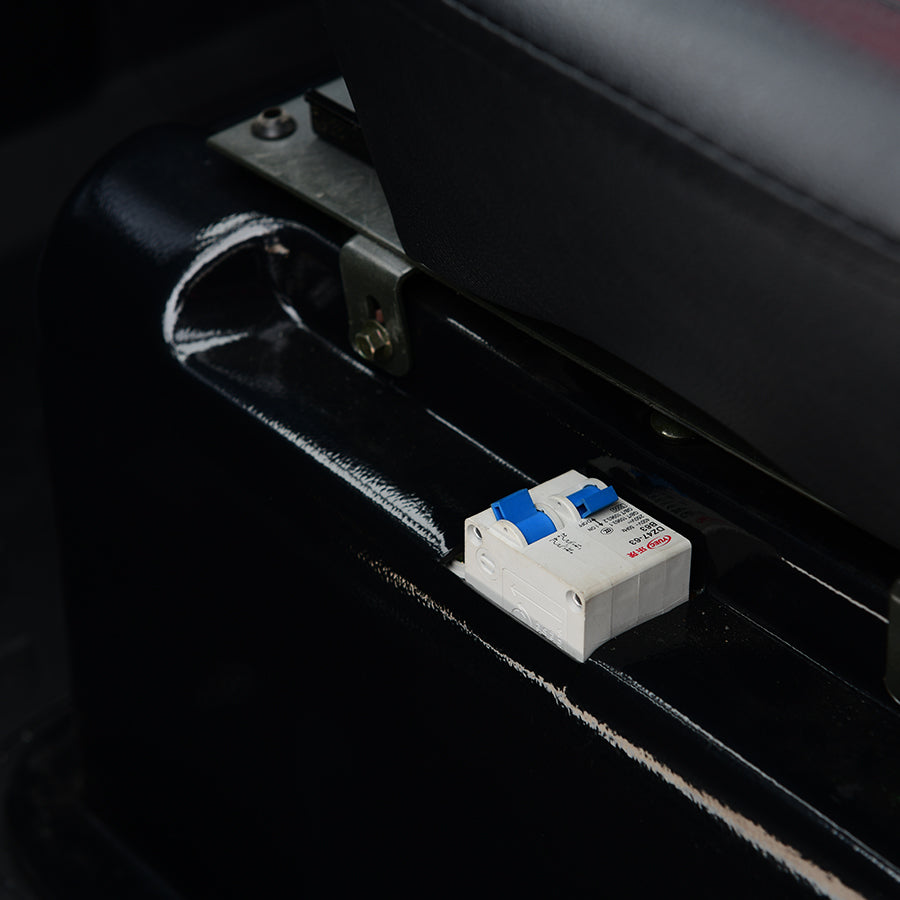

Master Switch

Located inside for easy access, the master switch powers the entire scooter on or off. It's your main control for safety, storage, or when the scooter’s not in use.

SPECIFICATIONS

| Specifications | |

|---|---|

| Recommended Height | 5'5" - 6'6" |

| Bike Weight | 77 lbs (35 kg) with battery |

| Bike Dimensions | Seat Height: 34" - 44.5" (86 - 113 cm) / Length: 76.4" (194 cm) |

| Packing Size & Weight | 58 x 11 x 31 in, 84 lbs (147 x 28 x 79 cm, 38 kg) |

| Total Payload Capacity | 330 lbs (150 kg) |

| Bike Geometry | |

|---|---|

| A - Stem to Saddle | 23.6" / 60 cm |

| B - Wheel Base | 47.2" / 120 cm |

| C - Total Length | 74.8" / 190 cm |

| D - Wheel Diameter | 29.1" / 74 cm |

| E - Handlebar Height | 43.3" / 110 cm |

| F - Seat Height | 34" - 44.5" / 86 - 113 cm |

| G - Handlebar Width | 28" / 71 cm |

| H - Standover Height | 31.5" / 80 cm |

| I - Bottom Bracket Height | 13" / 33 cm |

| Specifications | |

|---|---|

| Motor | 1000W (1200W peak), 85N·m, toothed, brushless hub motor |

| Battery | 48V 20Ah lithium-ion battery, waterproof rating IPX6 (included) |

| Battery Usage Tips | The recommended operating temperature is 5–25°C (41–77°F). Optimal performance occurs at room temperature. Avoid extreme heat or cold as it may reduce performance. |

| Range | 40–78 miles (Note: range may vary based on rider weight, terrain, slope, temperature, and battery condition) |

| Max Load | 330 lbs (150 kg) |

| Rear Rack Load | 62 lbs (28 kg) |

| Frame | 6061 Aluminum full suspension frame |

| Battery Charge Time | 9–10 hours |

| Battery Lifetime | 800 charge cycles |

| Transmission | Shimano 7-speed gear shift system |

| Green Transporter Q-Express Specifications | |

|---|---|

| LCD Instrument Panel | Yes |

| Back Up Camera | Yes |

| Electric Windows | Yes |

| Rear Window | Yes |

| Defroster | Yes |

| Radio | USB / Bluetooth / AUX |

| Rear Bench Seat | 34” x 15" |

| Body Size | 90” x 46” x 63" |

| Ground Clearance | 6.5" |

| Bench Height from Floor | 16" |

| Between Seat and Bench | 12" |

| Max Speed | 18 mph |

| Max Incline | 25 degrees |

| Motor | 60V 1200W Brushless |

| Battery | 60V 52Ah Lead Acid |

| Suspension | Integral Damping |

| Brake | Disc Brakes |

| Tires | 125/65-12 |

| Max Range | 25–35 miles |

| Max Capacity Load | 550 lbs. |

VIDEO